nj property tax relief for veterans

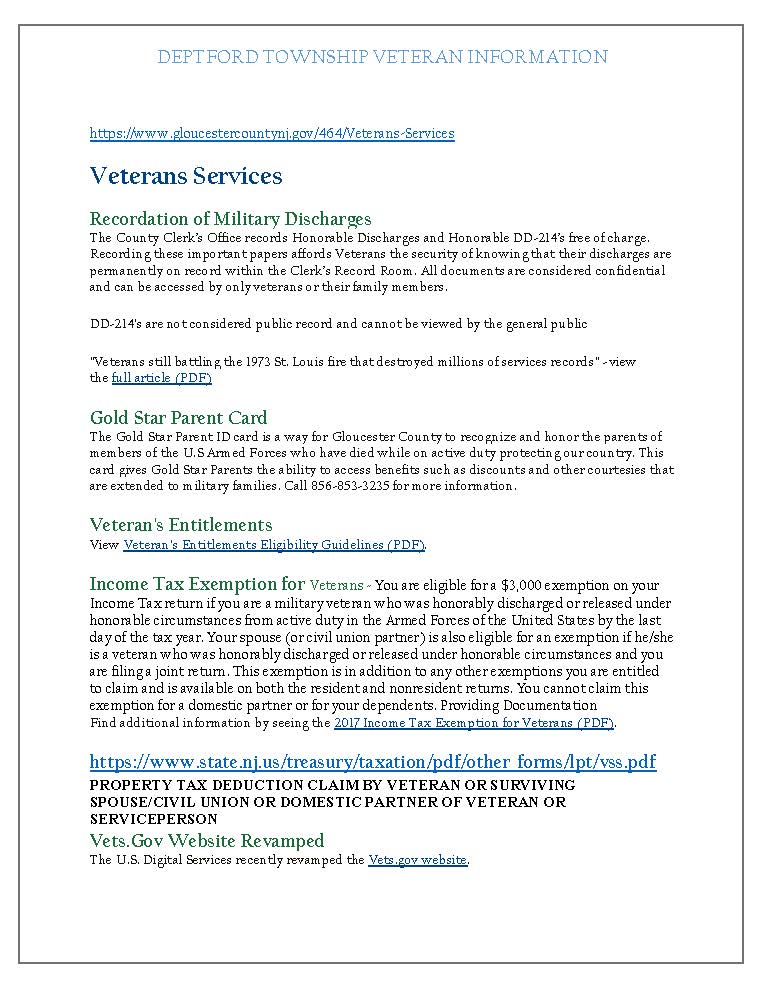

At least 14 days in a combat zone are eligible for an annual 250 property tax deduction. Effective December 4 2020 State law PL.

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center

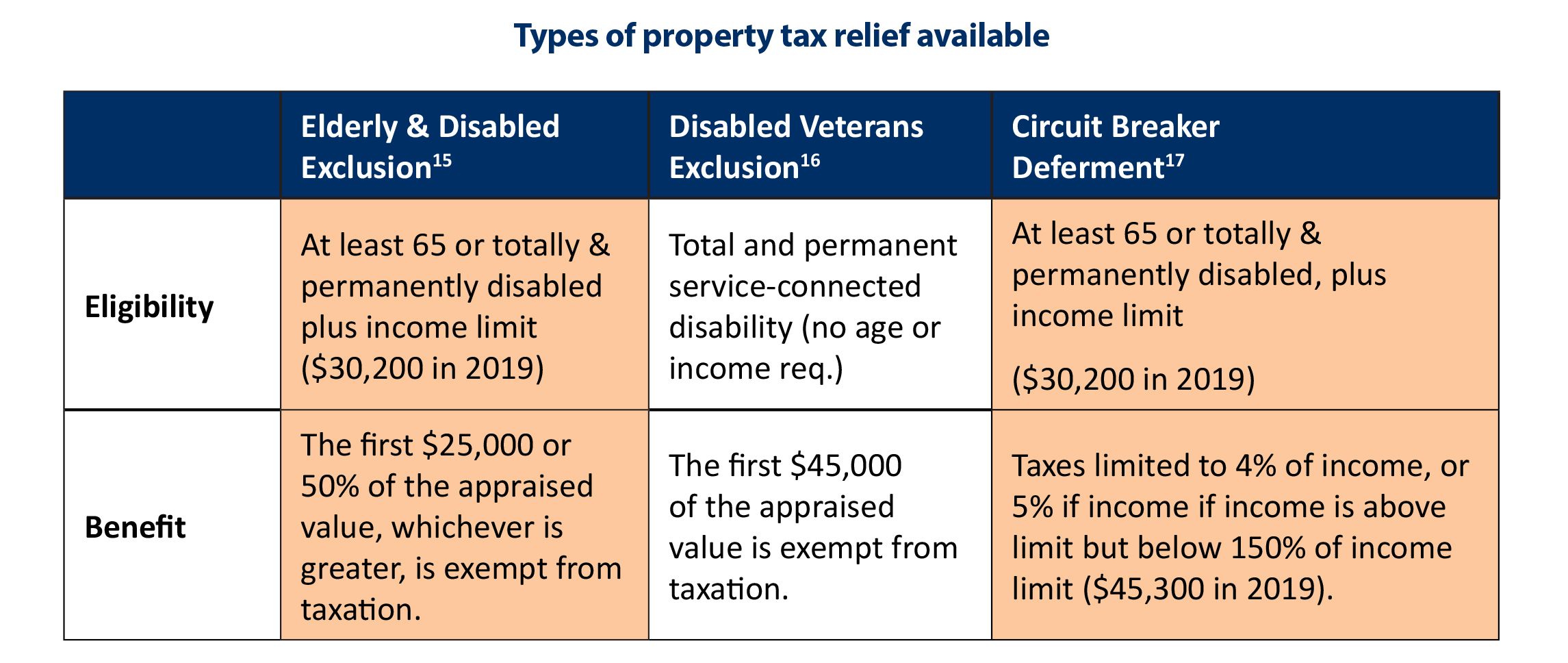

Here are some important things to remember about property tax exemptions.

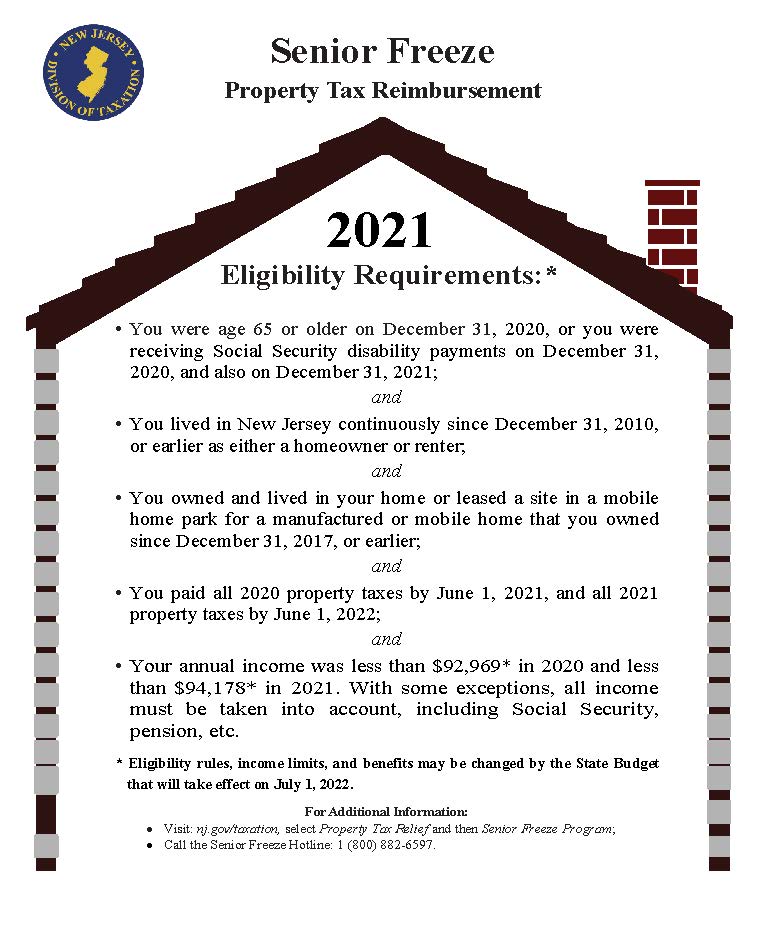

. Be 65 or older. The state of New Jersey provides several veteran benefits. To qualify for this exemption you need to.

New Jersey voters gave a resounding yes to expanding property tax benefits for veterans in last weeks election. Veterans must own their homes to qualify. If you are 65 or older or disabled and have lived in New Jersey for at least one year you may be entitled to a 250 property tax deduction each year.

If an eligible veteran has died their surviving spouse can collect the tax relief benefits. 413 eliminates the wartime service requirement for the 100 Totally and Permanently Disabled Veterans Property Tax. About the Company Property Tax Relief For Veterans In Nj CuraDebt is a company that provides debt relief from Hollywood Florida.

For the more than 290000 homeowners with a household income of between 150000 and 250000 a 1000 property tax benefit will be applied each year. The 100 property tax exemption for. The ballot question which passed with 76 of.

CuraDebt is a debt relief company from Hollywood Florida. It was founded in 2000 and is a member of the American Fair Credit. About the Company Nj Property Tax Relief For Veterans.

You can also apply if. NJ offers a property tax exemption for senior citizens disabled persons and their surviving spouses. Property Tax Relief Programs Property Tax Relief Programs Attention ANCHOR Applicants The deadline for filing your ANCHOR benefit application is December 30.

Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more. It was founded in 2000 and has since become a.

Tax And Sewer Collector Hopewell Township Nj Official Website

Veterans Benefits 2020 Most Popular State Benefit Va News

Union County Office Of Veterans Services County Of Union

Governor Phil Murphy Tax Relief Is A Critical Component Of A Stronger And Fairer New Jersey With Middle Class Tax Rebates An Expansion Of Our Earned Income Tax Credit The Long Overdue Updating

Township Of Nutley New Jersey Property Tax Calculator

All New Jersey Veteran Homeowners Now Qualify For The 250 Deduction West Amwell Nj

Murphy Proposes 900m Anchor Property Tax Relief Program New Jersey Business Magazine

N J Challenge To Reduced Property Tax Breaks Under Trump Tax Law Turned Away By Supreme Court Nj Com

Nj Election Expand Tax Aid For Veterans What You Need To Know

Property Taxes By State How High Are Property Taxes In Your State

Road To Recovery Reforming New Jersey S Income Tax Code New Jersey Policy Perspective

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Singleton Bill To Provide Property Tax Relief To Permanently Disabled Veterans Who Pay Rent Advances Nj Senate Democrats

The Official Website Of The Township Of Belleville Nj Tax Collector

Commissioners Support Legislation To Increase Property Tax Deduction For Veterans

Nj Voters Expand Property Tax Help For Veterans Here S How To Apply